Hill's Science Diet Puppy Amazon

Welcome to DataHawk's blog. In case it's your first time visiting DataHawk, we are a self-service software analytics and optimization platform used by leading digital agencies, retailers, and brands to boost their eCommerce performance on Amazon.

If you don't have the time to read a full study on competitive dynamics on the Dog Food segment on Amazon.com for the last 90 days,download the complete analysis for Dog Food here.

If yes, welcome, and have a good read!

Total pet market sales have steadily increased in the U.S. over the past years. Pet food was the highest-selling pet market product category in the United States in 2019 and is projected to maintain the top spot into 2020. Approximately 36.9 billion U.S. dollars of pet food was sold in 2019 and this is estimated to increase to around 38.4 billion in 2020. (Statista)

According to online sales measurement from Edge by Ascential, Pet Food sales on Amazon.com reached an estimated $1B in sales in 2018, up 20% compared to 2017.

Amazon also launched Wag in 2018, a proprietary brand for pet products that are currently available exclusively for Amazon Prime members. The rollout began with dry dog food, but Amazon eventually plans to include other product categories.

We're taking a look at the most popular Dog Food & Cat Food on Amazon at the moment.

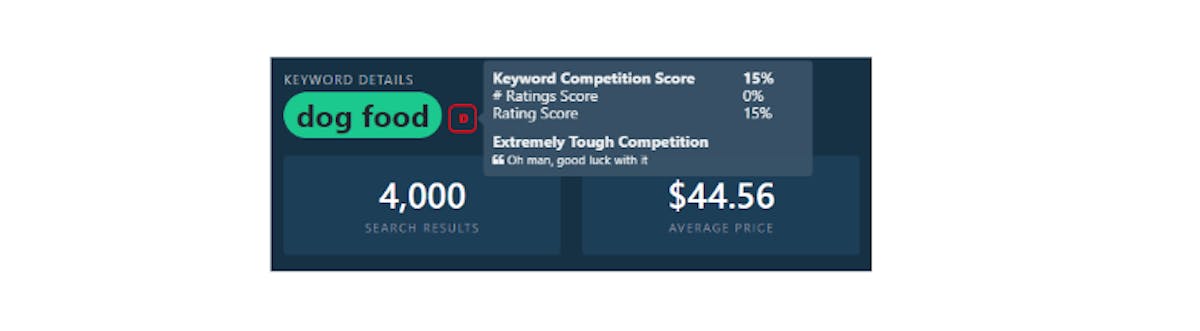

We leveraged DataHawk's Amazon rank tracking tool to analyze the competitive dynamics around the "Dog Food" & "Cat Food" keywords on Amazon by looking at products that appeared the most on the first page of search results over the past 30 days in the US.

DOG FOOD

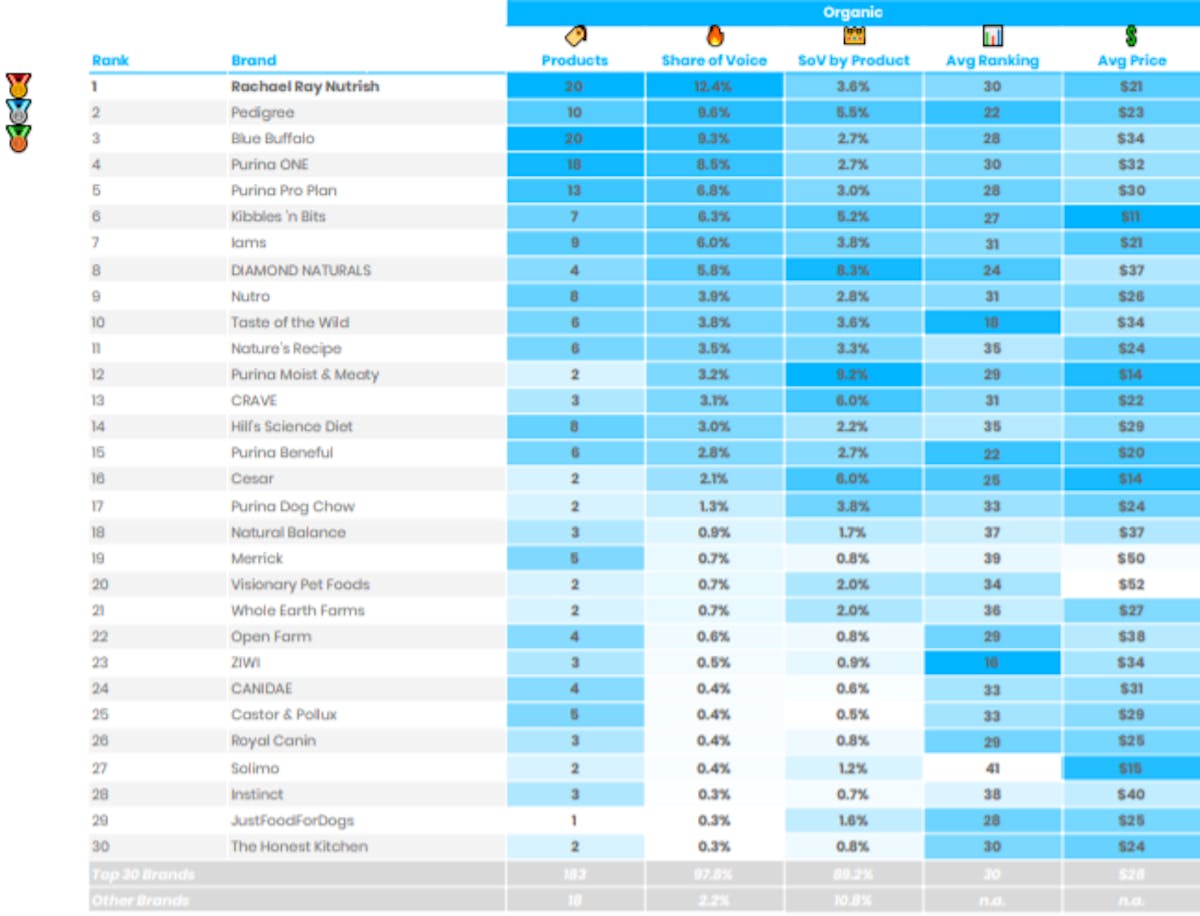

Share of Voice Organic Ranking Leaderboard

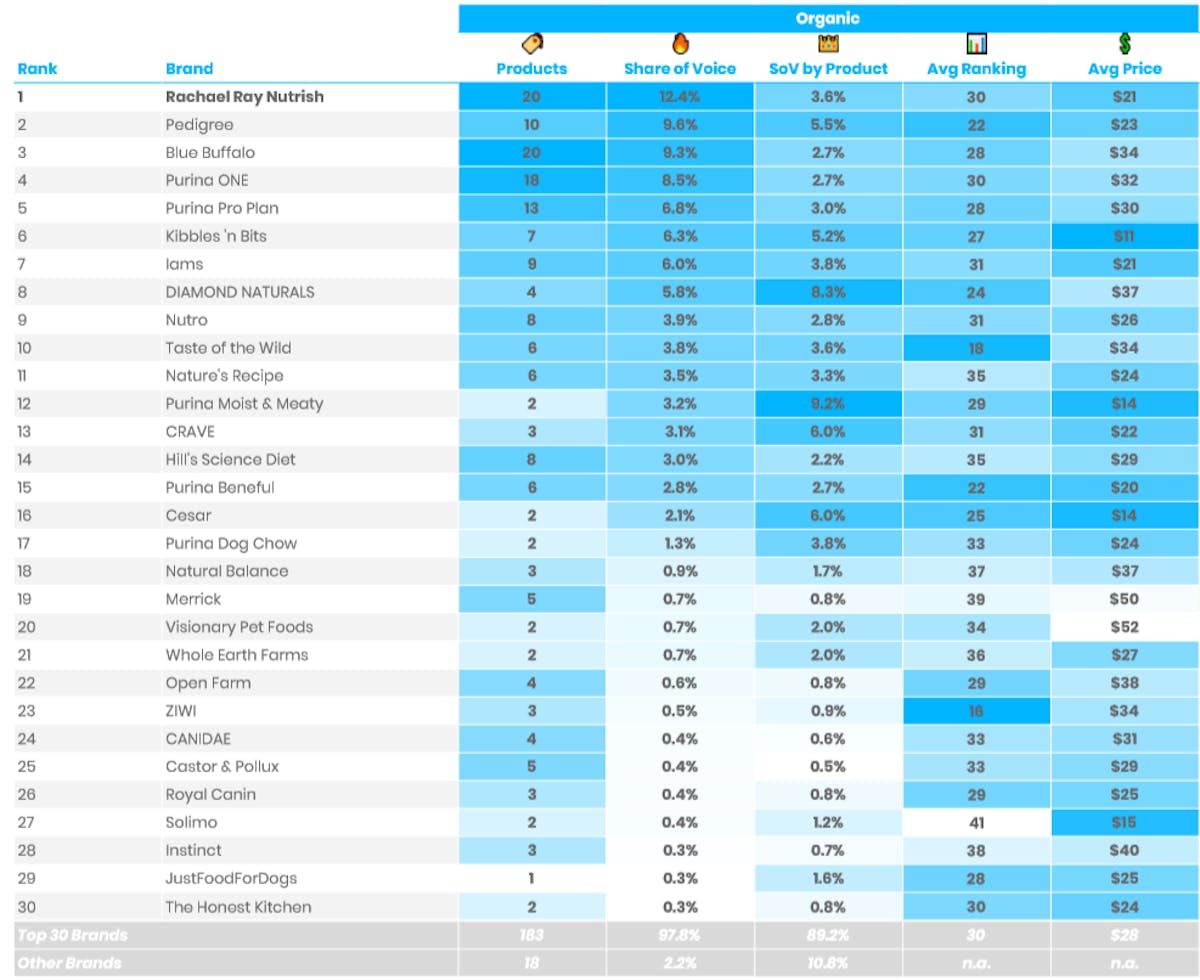

We analyzed 201 products from 47 brands ranking on page 1 for the Keyword "Dog Food."

Rachael Ray Nutrish & Pedigree are found to be the top two brands with 20 & 10 products each with a total share of voice of 22%. Blue Buffalo is in the third position and Nestle's Purina One is in the fourth position. The top 4 labels in this category cover a 39.8% share of voice in the Dog Food category on Amazon.

In our Share Of Voice Research, we analyze the number of days during which products belonging to each brand have ranked organically in our desired ranking range, for our analyzed period and for our desired set of search queries. The result is used to compute the Share of Voice and efficiency by product.

The top-performing Brand as seen above is Rachael Ray Nutrish, priced at an average $21, it has a share of voice of 12.3%. Pedigree is the nearest competitor to Rachael Ray Nutrish both in terms of pricing. However, it is striking that with exactly half the number of products, Pedigree is competing with Rachael Ray Nutrish. In fact, they have an average ranking of 22, much higher than both Rachael Ray Nutrish & Buffalo with 20 products on the rack.

Priced at $23 on average Pedigree has a share of voice 9.6%.

Having more number of products is clearly not the criteria for having a larger Share Of Voice. We have seen that previously in all our SOVs.

There are a number of other factors that impact this. One of them is the average price, a great indication of how pricing is impacting the organic ranking results on Amazon. The product with the highest average price - "Visionary Pet Foods" priced at $52 has a share of voice of only 0.7% out of a total of 47 brands that we have analyzed. In fact, the products priced in the range of $11 - $30 capture 66.5% of Share Of Voice from the top 30 brands on Page 1 for this query. The other brands left with a share of Voice of 33.5% are priced at an average of $40.9.

The best average ranking list is dominated by Taste of the Wild & Ziwi with only 6 & 4 products each.

Next in the list is the Purina Beneful with 6 products at rank #15. In fact, there are 8 Purina Brands on Amazon. Nestlé Purina is an American subsidiary of Nestlé. Some of its pet food brands include Purina Pro Plan, Purina Dog Chow, Friskies, Beneful and Purina ONE. If we calculate the share of voice of Purina on page 1 on Amazon, 5 Purina brands made it to the top 30, capturing a share of voice of 22.6%. The 41 Purina products on the list are priced at $30 on average.

We also found that the average price of the 30 brands ranking organically on page1 is $28. The top 10 Brands capture a 72.2% Organic Share of Voice out of a total of 47 Brands that had at least one product that made it to page1.

Amazon Solimo made it to the Top 30 list with 2 products and an average price of $15, much lower than the average price of the top 30 in the category. Another Amazon's private label, Wag (that did not make it to Top 30), garnered plenty of attention when it was launched. The price is right, it's marketed with buzz words people love like "grain-free," "meat from the US" and "all-natural." Wag had been part of Quidsi, which Amazon purchased for $545 million in 2011.

Wag is price competitive with other frequently purchased, "everyday" brands of dog food. For instance, A 30-pound bag retails for $44.99; a similar size bag of Purina Pro Plan sells for about the same price.

Purina has been pushing the bars very high with its amazing eCommerce marketing on the Amazon platform. They have categories like "Subscribe" & "28 Day Challenge" on their store page, very efficient in attracting and retaining customers.

Want to analyze the same for your favorite search query and understand how you can monitor organic performance and map share of voice? Read here.

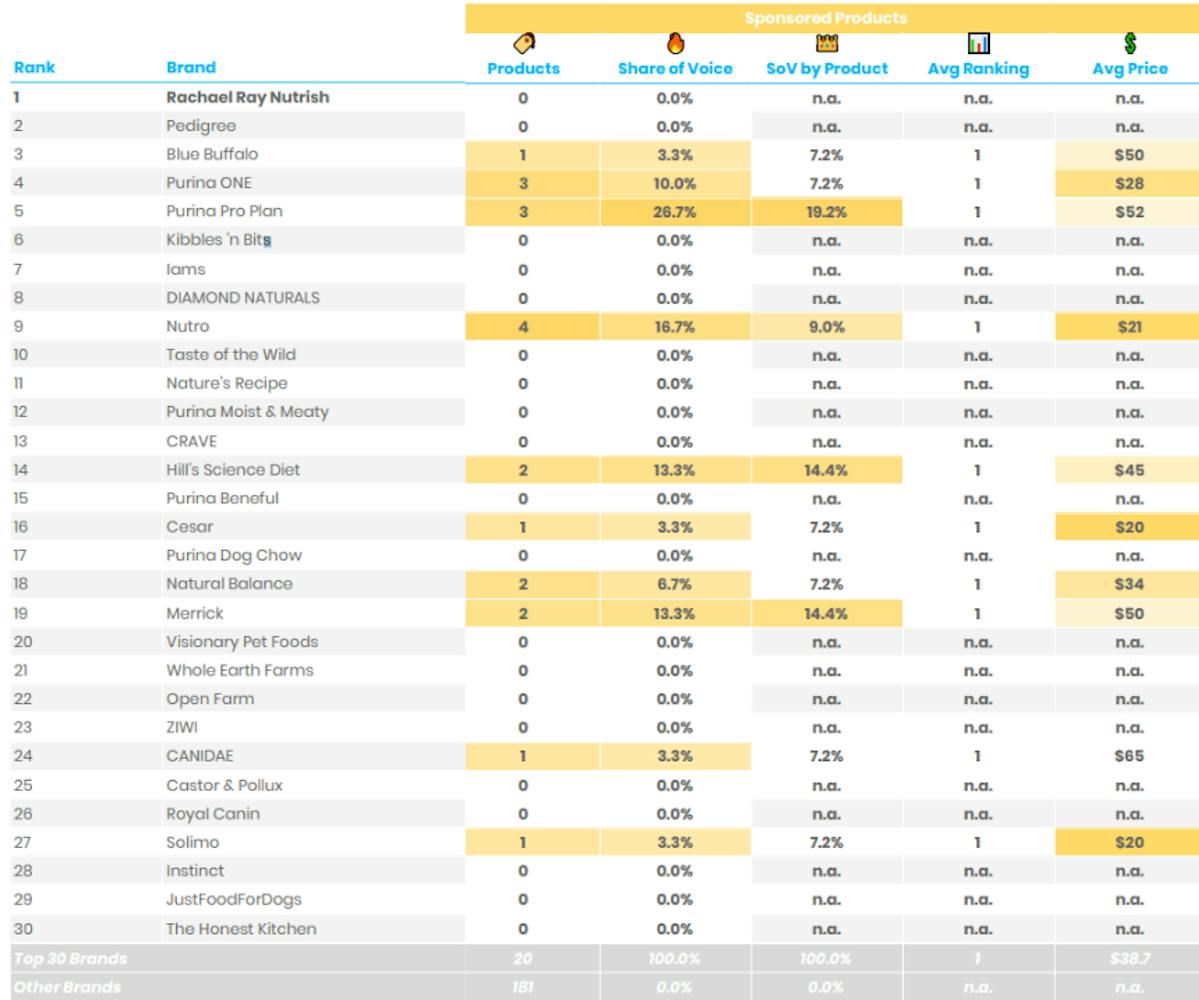

Share of Voice Sponsored Ranking Leaderboard

Here is an overview of the brands that had sponsored products spending the most time in the top rankings for the analyzed keyword "Dog Food".

The top-performing Brands, Rachael Ray Nutrish & Pedigree with 20 & 10 products in the organic section no products as sponsored on Page1.

Blue Buffalo, rank #3brand with 20 products has 1 product as sponsored making a 3.3% share of voice in the sponsored products section. Out of the top 30, there are only 10 brands with sponsored products ranking on Page 1. There are 4 brands on the list with only 1 sponsored product and average pricing of $38.7

We also found that all the sponsored products in this category are falling in the Top 30 brands list, possibly sitting on page1.

It is rather interesting to see that the brand "Nutro", ranked 9th, has the most sponsored products on Page 1, bagging an SOV of 16.7%. Purina Pro Plan has the highest SoV in the sponsored products section with only 3 sponsored products and a share of voice of 26.7% .

We also found that amongst the top 10, only Kibbles 'n Bits is a brand that has an average price with a difference of more than 10$ from the average price.

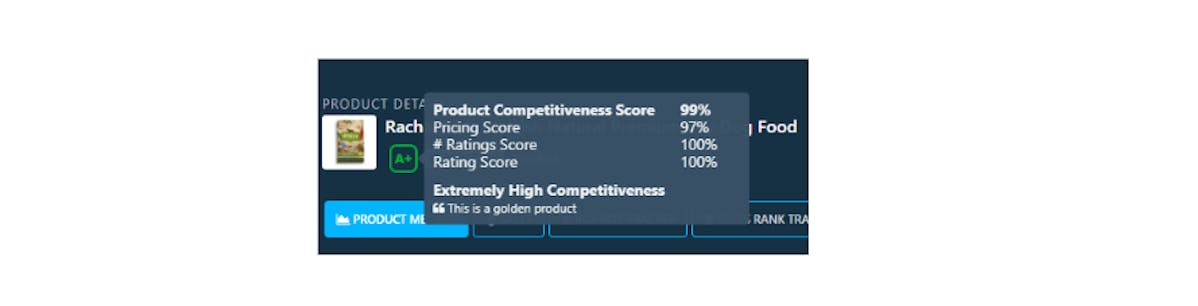

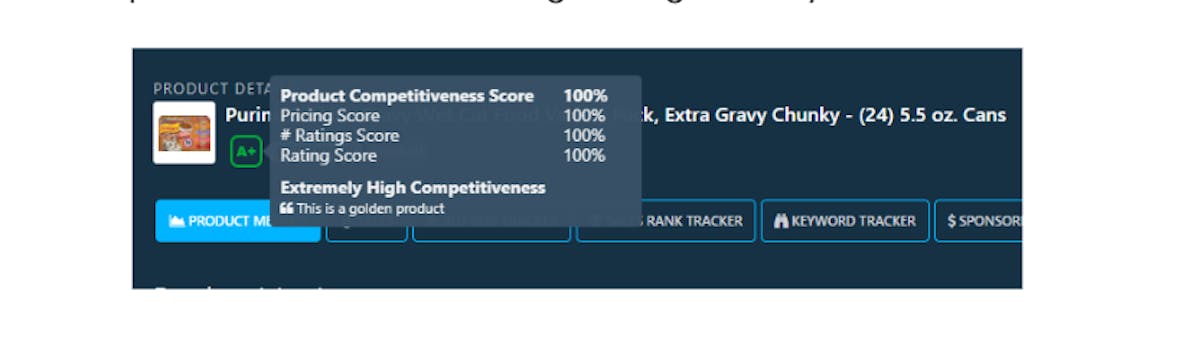

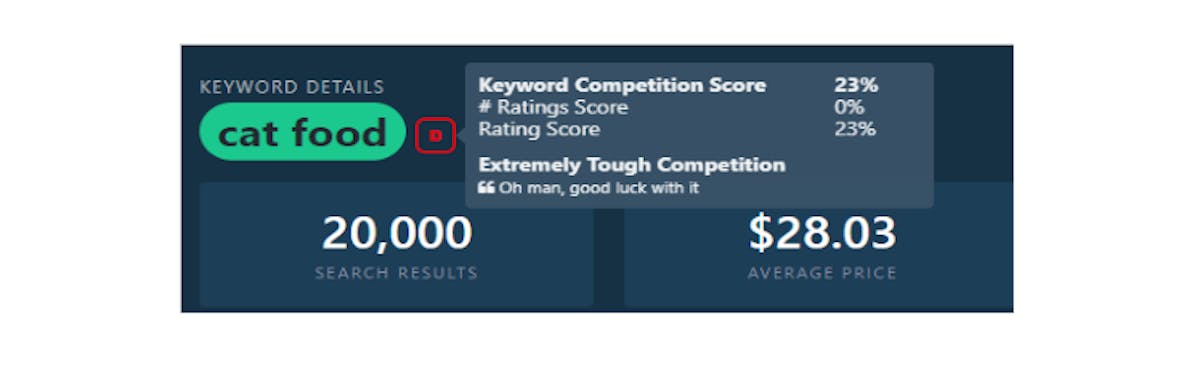

At DataHawk, we also compute product competition scores that reflect what extent the product is deemed to be competitive on Amazon and it's based on a set of parameters such as the Pricing, Reviews, and Ratings of the competing products that are ranking for a given keyword. Here is our scorecard for the top competitor in this category. You can analyze your competitor's score using Amazon seller analytics software by DataHawk.

It can be inferred that the competition in this category is super high, especially for the top 10 rank positions. A product in this category with good ratings and in the average price range could make it to the top 30 for sure.

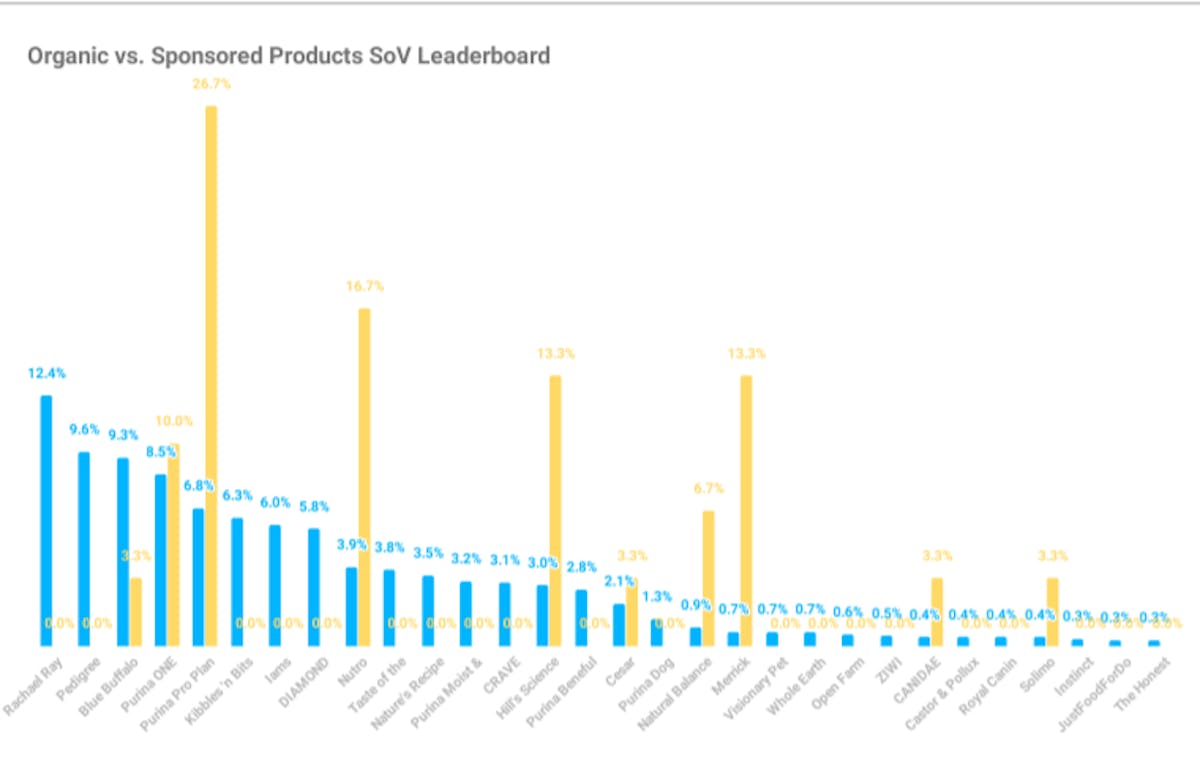

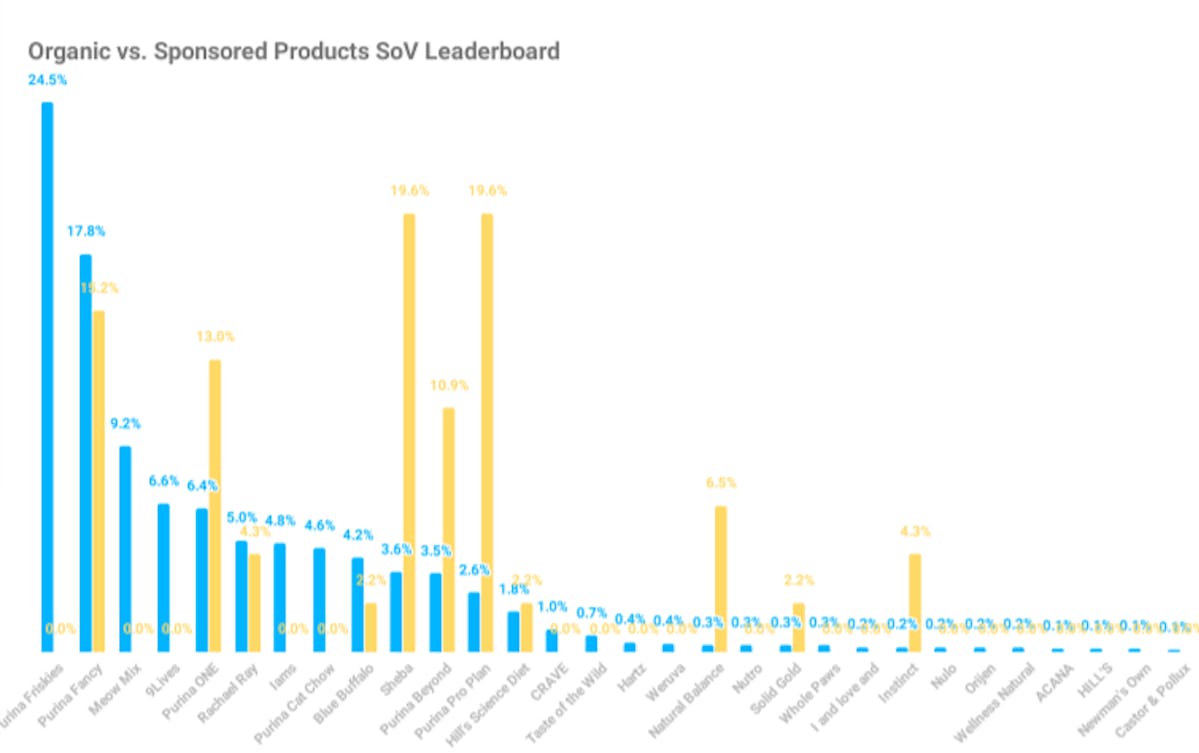

The Organic vs. Sponsored Products SoV Leaderboard

It can be seen here that the most sponsored products come from the brands -Purina Pro Plan, Nutro, Hill's Science and Merrick. It is significant that Rachael Ray & Pedigree are two top brands ranking organically with no sponsored products. They have a combined 22% share of voice on the first page. The competition for this keyword "Dog Food" is seen to be tough but with the right insights and correlations, it is vincible.

66.7% brands have products ranking for this Keyword are ranking organically with no sponsored products. If you are a brand in this niche it is important to understand how using smart branding and carefully designed packaging, innovative brands are able to differentiate themselves from their competition. It can be said that the online pet food business may be there for the taking for the company that gets it right.

During a survey by Statista, approximately 44 percent of respondents said they purchased pet products online because it's a convenient option, allowing them to shop from anywhere at any time.

The Organic Share Of Voice vs. Average Selling Price

With its concept of tailored nutrition Iams has surely made its own space in this niche. Priced at 21$ it offers a solid competition to bigger brands(with majority products on page 1) like Rachael Ray Nutrish, Pedigree, Blue Buffalo, Purina ONE, Purina Pro Plan and Kibbles 'n Bits. It also competes with the above brands in terms of pricing.

This graph is very helpful to identify the competition on the basis of Average Selling Price. In the "Dog Food" category we can see two big groups divided on the basis of Share Of Voice.

We have also analyzed another sub-category in Pet Food, "Cat Food."

CAT FOOD

Approximately 55% of US consumers purchased pet products on Amazon in 2018. Sales of cat treats saw the highest growth (24.9%) between 2017 and 2018, while cat food represented the least growth (15.2%). (Profitero)

Share of Voice Organic Ranking Leaderboard

We analyzed 168 products from 36 brands ranking on page 1 for the Keyword "Cat Food."

Here is an overview of the brands that had products spending the most time in the top rankings organically for the keyword "Cat Food".

The top-performing Brand is Purina Friskies, priced at an average $13, it has a share of voice of 24.5%.

Another one from Nestle, Purina Fancy Feast is occupying the second position with a share of voice of 17.8%. Purina with its 7 brands in Top 30 in the Cat Food category is surely dominating the share of voice by 59.5%.

Mellow Mix & 9 Lives on positions 3 & 4 are competing with the big sharks Purina & Rachael Ray Nutrish. With 11 & 6 products each, they have a share of voice of 15.8% and the lowest prices in the category. In fact, most of the brands in the top 10 are priced below $20 which is quite lower than the average price. We also found that the average price of the 30 brands ranking organically on page1 is $29.

Unlike our previous share of voice analysis, for the Cat Food category, we can see that the brands with more number of products along with lower price range have a larger Share Of Voice. The average price of the top 10 brands is $17 only. The top-ranking products here have the highest number of ratings in the group. So, it is not only the number of products that impact the rankings, there are other factors involved too. These include pricing, reviews, ratings, star ratings, and more.

The product with the highest average price - "HILL'S PRESCRIPTION DIET" priced at $63 has a share of voice of only 0.1% out of a total of 36 brands that we have analyzed. In fact, the products priced in the range of $10 - $25 capture 85.5% of Share Of Voice from the top 30 brands on Page 1 for this query. The other brands left with a share of Voice of 14.1 % are priced at an average of $38.68.

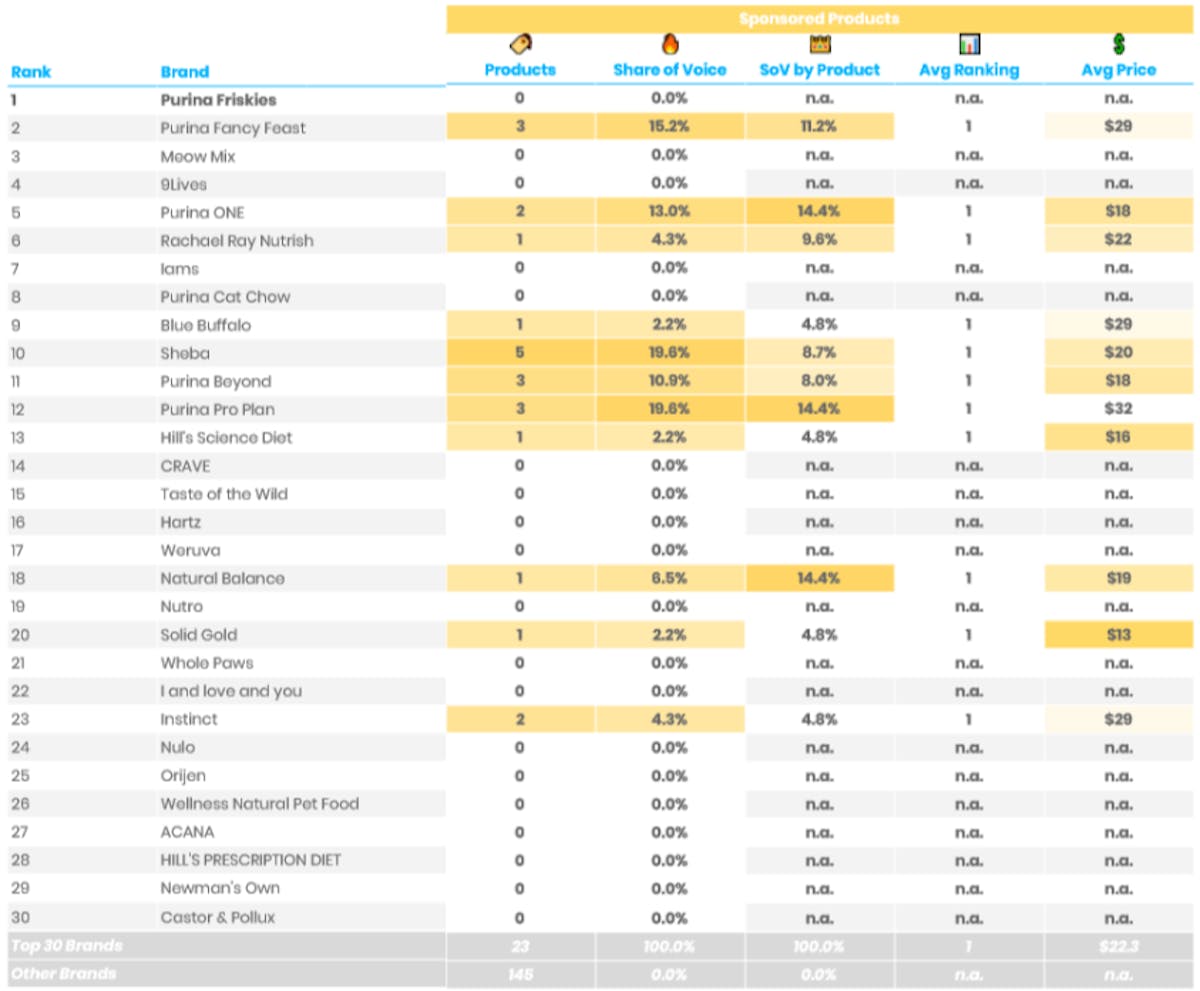

Share of Voice Sponsored Ranking Leaderboard

Here is an overview of the brands that had sponsored products spending the most time in the top rankings for the analyzed keyword "Cat Food".

The top-performing Brand, Purina Friskies with 23 products in the organic section has only 0 products as sponsored on Page1. Purina Fancy Feast on rank#2 has 3 products as sponsored on Page 1.

Out of the top 30, there are 12 brands with 23 sponsored products ranking on Page 1. It is rather interesting to see that the brand "SHEBA" that has the highest number of ratings, has the most sponsored products on Page 1, bagging an SOV of 19.6%. Rachael Ray Nutrish has a 4.3 % SoV with only 1 sponsored product priced at $22. The highest average price in the sponsored section is of the brand Purina Pro Plan.

Here's the Product Competition Score for the top competitor that reflects to what extent the product is deemed to be competitive on Amazon, based on a set of parameters such as the Pricing, Reviews, and Ratings of the competing products that are ranking for a given keyword.

It can be inferred that the competition in this category is super high, especially for the top 10 rank positions. A product in this category with good ratings and in the lower price range could make it to the top 30 for sure.

It can be seen here that the most sponsored products come from the brands -Sheba, Purina Pro Plan, Purina Fancy Feast, Purina ONE. It is significant that Purina Friskies, Meow Mix & 9Lives are topping the charts by ranking organically with no sponsored products. They have a 40.2% share of voice on the first page. The competition for this keyword "Cat Food" is seen to be tough but with the right insights and correlations, it is vincible.

Most of the products ranking for this Keyword are ranking organically. If you are a brand in this niche it is important to understand the pricing and marketing strategy and follow the trends of the niche you are selling in.

The Organic Share Of Voice vs. Average Selling Price

Meow Mix has surely made its own space in this niche. Priced at 10$, the minimum price in the category, it offers a variety of dry and wet cat food. This Smucker's subsidiary has been in the business for over 45 years.

We can clearly bifurcate the category on the basis of Share Of Voice. There are brands with a high share of voice and low average pricing & there are brands with a low share of voice and high average pricing.

This graph is thus very helpful to identify the competition on the basis of Average Selling Price and understand what group are you falling in and who are your direct competitors.

We can see that 9Lives ranking organically is in very close competition with Rachael Ray Nutrish, both ranking for 6 products each at the same price. The difference in their average rankings is significant.

It is significant that brands are challenged with building a loyal consumer base in multiple directions, especially in a category like Pet Food and, at the same time faced with the difficulties in competing with the wave of agile, innovative smaller brands that are founded on similar values, and a strong sense of self-expression. It is thus very important to have a clear picture of who you are competing with and how.

Both the categories that we analyzed have a lot of common players. Purina is a clear leader in the category winning the major share of voice in both the categories together.

The brands that have a hold-in both the subcategories are Purina One, Purina dog/cat chow, Purina Pro Plan, Rachael Ray Nutrish, Iams, Blue Buffalo, Hill's Science Diet, CRAVE, Taste Of Wild, Natural Balance, Nutro, Instinct.

Nutro has the same number of products in both categories, with homogeneous pricing in both subcategories.

We found that all these brands have more products in the Dog Food category than the Cat Food category that are ranking organically on Amazon. However, for the sponsored section, there are more products in the Cat Food category.

DataHawk enables you to make such an analysis very quickly. Download the complete analysis here.

Our study helped us analyze the best and lowest-ranked products in the Pet Food category. Understanding why some products are best-sellers gives a blueprint to brands and sellers to follow. You can get all these tips and tricks with DataHawk.

Read our 2min guides and use cases to master ranking on Amazon. Also, Also, In case you need help to draw insights from your data, you can check DataHawk'sAmazon Advisory Services right here.

Get the latest eCommerce and Amazon insights and trends delivered straight to your inbox

Hill's Science Diet Puppy Amazon

Source: https://datahawk.co/blog/res-amazon-share-of-voice-analysis-pet-food

0 Response to "Hill's Science Diet Puppy Amazon"

Post a Comment